War Tax Refusal

A Biography of Karl Meyer (5-25-2020)

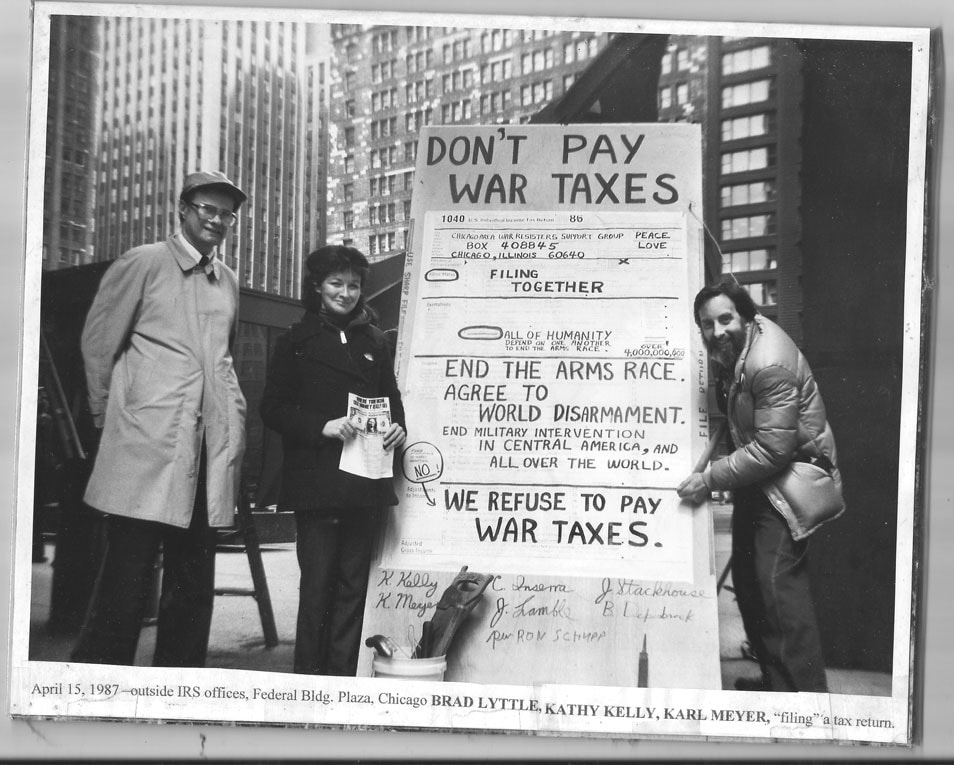

Bradford Lyttle, Kathy Kelly, Karl Meyer - three key instigators of mass war tax refusal during the Vietnam War, and the "little wars" of imperial domination in Central America in the 1980s - physically filing a tax return outside the IRS office in Chicago, April 15, 1987.

New Resistance To War Taxes

by Karl Meyer, publication in The Catholic Worker, January, 1971

[excerpts, edited to remove references to IRS Code, Regulations, Forms and processes that were specific to 1970-71. For current rules and forms for 2020, see: the Controlling Federal Income Tax Withholding pamphlet available from the National War Tax Resistance Coordinating Committee, www.nwtrcc.org ]

“Under penalties of prejury, I certify that I incurred no liability for Federal income tax for 1970 and that I anticipate that I will incur no liability for Federal income tax for 1971.”

If you can sign that statement, you can stop the withholding of war taxes from your wages……..

Who is eligible to claim this exemption? I say, “Everybody.” It is morally impossible to incur a liability to support evil purposes and actions. Since at least [50%} of Federal income taxes is spent for military or war-related purposes, and much of the balance for useless or harmful purposes, it is impossible to incur a liability to pay Federal income tax……

Now, it has always been a puzzle to me how a person who believes in conscience that taxes should not be paid could file a return showing taxes as a “balance due.” That is self-contradictory. If the tax is acknowledged to be due, it ought to be paid. If it ought not to be paid, it shouldn’t be shown as “due.”

The IRS calls the income tax a “self-assessed tax.” When you file showing tax due, they are empowered to accept your assessment and proceed to collect immediately. If you show no tax due, even if they disagree with you, they must first reassess the tax themselves and give you extensive opportunities for legal appeals, before they may proceed to collect on their claim. Therefore, it is foolish and self-defeating to show tax as due, if you sincerely believe that it ought not to be paid.

There are several ways to assert your claim that no tax is due……………………………………

Perhaps the soundest approach is to file no return at all. (The main disadvantage of this, besides being illegal, is that IRS agents sometimes file distorted returns in your name, claiming excessive amounts of tax.) I didn’t file for ten years, but IRS agents filed seven returns in my name showing more than $2000 in tax and penalties due.

On April 6, 1970, I filed a return for 1969 in a personal interview with E.P. Trainor, the District Director at the Chicago office of IRS. On the 1040 Form, I filled in my name and address. Under Social Security Number, I wrote “Peace;” under Occupation, I wrote “Love;” across the face of the return I wrote in bold letters, “ WE WON’T PAY—STOP THE WAR—STOP THE DRAFT—STOP MILITARISM,” for First Names of Dependent Children, I wrote “All Men Are Brothers;” under Other Dependents, I claimed “A Vietnamese child killed at Song My, an American soldier killed in Vietnam;” and I filled in a total of three and a half billion exemptions for the whole population of Earth; under Balance Due, Pay in Full with Return, I put “$0.00;” then I signed with my name and the date.

Mr. Trainor and his henchmen haven’t figured that year out yet, but they can’t say I didn’t file.

Before you follow my advice and my example, I wish to speak a word of caution: Everything here is my interpretation. Don’t expect the IRS, U.S. Attorneys, Federal juries, or Courts of Appeal to buy a word of it. In the November 1969 and January 1970 issues of the Catholic Worker, I published landmark articles on how to claim sufficient exemptions on the W-4 Form to prevent the withholding of war taxes. Many people all over the country tried out these ideas effectively, but several lost their jobs for persisting, and three were tried and convicted in Federal courts for claiming illegal exemptions. If you can’t stand heat, stay out of the kitchen. If you can’t do time, don’t commit crime.

If you have a concern of conscience about paying war taxes, but feel unready to face the possible consequences of the methods of resistance outlined above, the present tax rate provisions give ample opportunity to stop paying war taxes, without violating any provisions of the tax laws, if you are willing to live in reasonable simplicity and voluntary poverty in the spirit of the Catholic Worker movement……

I do believe that we should all strive to live in a simpler way. If we work part time for wages and live on less than taxable incomes, we will have extra time to grow, create, and do more things for ourselves, or to offer our work as a gift to people in need of it. Even if we work full time for taxable wages, but successfully resist collection of the taxes, we should still live simply in order to share our surplus money with others who are in need. I have done this all my adult life and intend to go on with it.

One hundred and eighty years ago, our brother rebel Tom Paine wrote:

“…were an estimation to be made of the charges of Aristocracy to a Nation, it will be found nearly equal to that of supporting the poor. The Duke of Richmond alone (and there are cases similar to his) takes away as much for himself as would maintain two thousand poor and aged persons. Is it then any wonder that under such a system of Government, taxes and rates have multiplied to their present extent?

In stating these matters, I speak an open and disengaged language dictated by no passion but that of humanity. To me who have not only refused offers because I thought them improper, but have declined rewards I might with reputation have accepted, it is no wonder that meanness and imposition appear disgustful. Independence is my happiness, and I view things as they are, without regard to place or person; my country is the world, and my religion is to do good.” (The Rights of Man, Modern Library edition, page 241).

If we do not live by these principles, how are we different from the warfare state we condemn?

The budget and accounting methods of the Federal administration are confusing. They have recently been modified to deliberately de-emphasize the role of military expenditures as a proportion of the Federal budget, enabling Nixon to claim that they count for less than 50%. This has been done by counting all separately raised and earmarked revenues, such as Social Security revenues and payments, as part of one budgetary total. Then the large Social Security payments can be thrown in the pot and counted as part of domestic expenditures for health and welfare.

Rejecting this ruse, it is possible without detailed analysis to estimate that [about50%] of all Federal income and excise tax revenues is spent for military programs and purposes that are intimately related to the cost of past and present military activities. According to individual judgment, this estimate might include veterans benefits, space research and technology, various “international affairs” programs, certain “Justice Department” activities, a percentage of the general administrative expenditures, and the interest and principal payments on the national debt, incurred primarily as a cost of World War II and the Cold War.

Awareness of these facts, plus the explanation of new methods of resistance, contributed to a tremendous growth in the movement of war tax resistance in 1970. In late 1969 a national coordinating center called War Tax Resistance was established in New York. Its periodical bulletin, Tax Talk, lists 181 local centers of contact people all over the country…………………………………………………..

War Tax Resistance estimates that 15,000 people participate in some form of income tax nonpayment, as a principled protest against militarism.

We speak of those who consciously and explicitly relate to the war tax resistance movement, because we know that millions of our countrymen, from the highest to the lowliest, participate in tax resistance or evasion, largely because of unarticulated opposition to the basic policies of government. They will be our allies if their protest can be come articulate and organized.

The most promising development in 1970 was the significant number of people who began to successfully resist payment of all or most of the income tax amounts that would be claimed under Federal law and regulations. Until 1970, the number of such total tax resisters was small and almost exclusively limited to self-employed persons or others who derived most of their income from sources not subject to withholding tax.

In articles for the Catholic Worker (November 1969 and January 1970), I explained how to beat withholding of tax by claiming enough exemptions on the W-4 Form that no tax could be withheld from one’s wages. Widely reprinted and circulated in leaflet form, these articles offered an effective tax resistance method to almost any wage earner who had the courage to try it and risk the possibility of prosecution or harassment sometime in the future.

In his last letter to me before his death, Ammon Hennacy, a pioneer influence in our war tax resistance movement, glumly predicted that from fear of going to jail, there wouldn’t be more than a handful in the country that would take up my idea. But Ammon was wrong in this case. I know that many have taken it up, and they are growing in numbers, because I keep hearing from them, particularly those in the Chicago area. Thousands of dollars have been held back from the military machine and donated to alternative uses that meet the real needs of people.

This movement will continue to grow from roots that are deep in the American tradition. The ideas of Thoreau’s “Essay on Civil Disobedience,” fruit of his brief imprisonment for war tax resistance, are well-known today. But a century before Thoreau, our forefathers made their stand for independence in resistance to unjust taxes. Both the American Revolution and the French Revolution were organized around the issue of resistance to taxation. Tom Paine understood this well because he was active in both.

In 1791, he published in England a powerful polemical tract on The Rights of Man to stir the people of England to a similar revolt. His most persistent theme of grievance is the criminal burden of war taxes imposed on the people by power hungry men in government.

He vividly describes the genesis of the French Revolution, including the refusal of the Parliament of Paris, in 1788, to register the edicts of the King and Government seeking to enforce new taxes:

“While the Parliament were sitting in debate on this subject, the Ministry ordered a regiment of soldiers to surround the House and form a blockade. The members sent out for beds and provisions, and lived as in a besieged citadel; and as this had no effect, the commanding officer was ordered to enter the Parliament House and seize them, which he did, and some of the principal members were shut up in different prisons…. But the spirit of the Nation was not to be overcome, and it was so sensible of the strong ground it had taken, that of withholding taxes, that it contented itself with keeping up a sort of quiet resistance, which effectively overthrew all the plans at that time formed against it.” (Rights of Man, Modern Library edition, page 149).

On this strong ground, let us also take our stand for a quiet battle, more effective against wrong, more productive for good purposes than any other I can think of.

Yours for a gentle revolution, Karl Meyer, January 1, 1971

Green Eggs & Ham

April 15, 1975

Federal Building Plaza, Chicago

For fifteen years, various Internal Revenue agents have been trying to cajole, persuade, threaten, or coerce me into paying taxes, even though I keep saying to them:

Federal Building Plaza, Chicago

For fifteen years, various Internal Revenue agents have been trying to cajole, persuade, threaten, or coerce me into paying taxes, even though I keep saying to them:

Listen, I do not like to pay for arms;

I do not like to do much harm.

I do not like it, Uncle Sam;

I do not like green eggs and ham.

And they say to me:

Try it, try it, just this year;

Try it, try it, have no fear.

Try it now the war is ended,

Or your judge may be offended.

Withholding makes it very easy

to still your conscience when it’s queasy.

You will like it once you pay.

You will do it every day.

Pay your tax like other folks;

We are tired of your jokes.

And I say to them:

I will not let you take my pay;

I will not stand it for a day.

I will not pay you with a check;

I will not pay this year or next.

I will not pay, I will not budge,

I will not pay them to a judge;

I will not pay them through the mails;

I will not pay them in a jail.

Sort through your tons of canvas sacks;

You will not find my income tax.

I do not like to pay for arms,

I do not like to do much harm;

I do not like it Uncle Sam,

I do not like green eggs and ham.

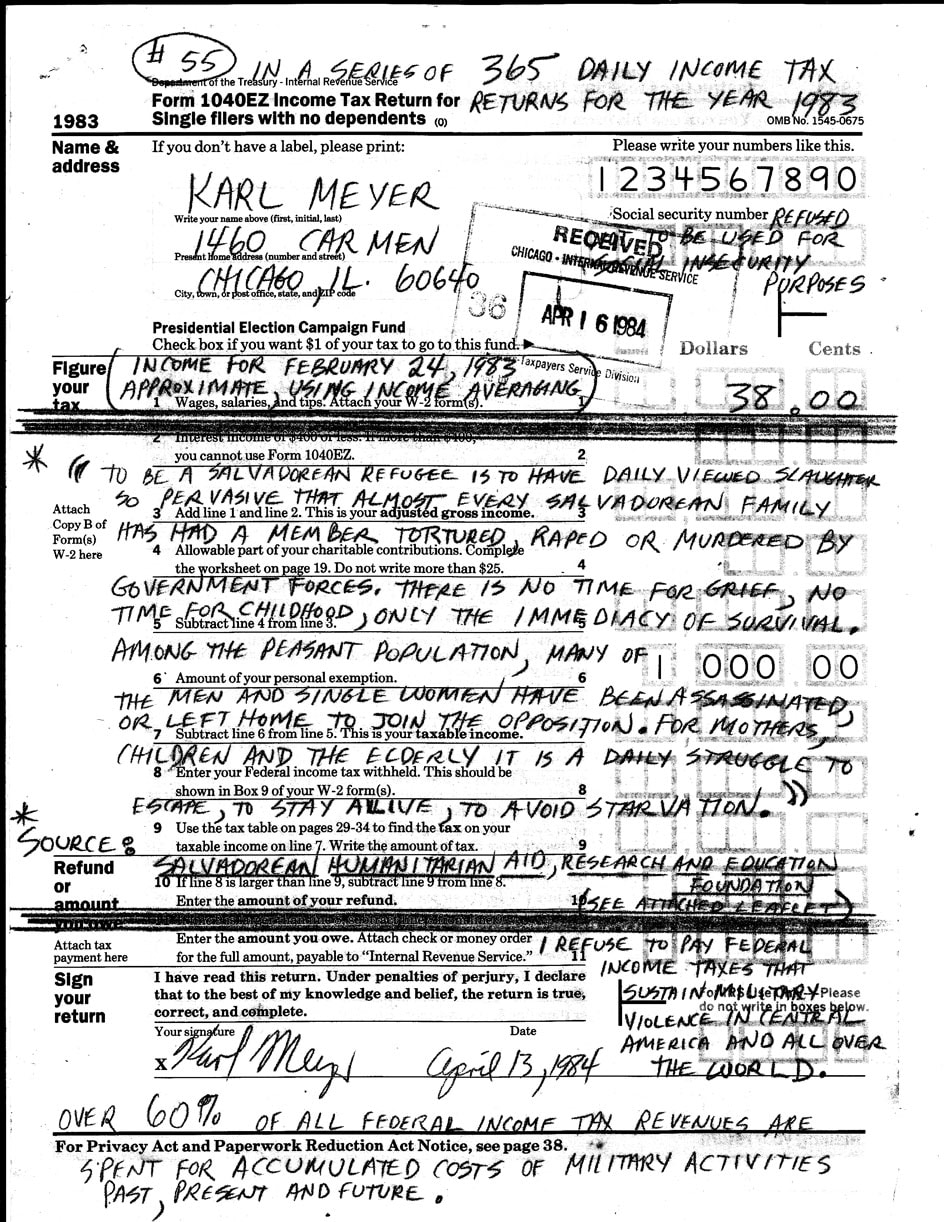

One of 365 daily income tax returns mailed to IRS offices all over the United States in 1984 to challenge a new $500 civil penalty for "frivolous returns". I was fined a total of $140,000, of which the IRS succeeded in collecting only $1000 by seizing and auctioning my station wagon (at a cost far greater than the revenue realized). This action generated nationwide media attention, including stories in the Wall Street Journal, Washington Post, Chicago Tribune, and many other papers.